Prepared Food Tax Virginia . The meals tax (also known as the food and. Some virginia officials are exploring a potential new revenue stream by considering a. This is a 4% tax, (in addition to. prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. last updated 23 may 2024. reduced tax rate applicable to food and essential personal hygiene products beginning january 1, 2023, the 1.5 percent. Food purchased for home consumption is taxed at the reduced rate of 2.5% (1.5% state, 1% local). the city’s meals tax is managed by the department of finance’s business unit. “prepared hot food sold for immediate consumption on or off the premises” in virginia are taxed at the full. effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages.

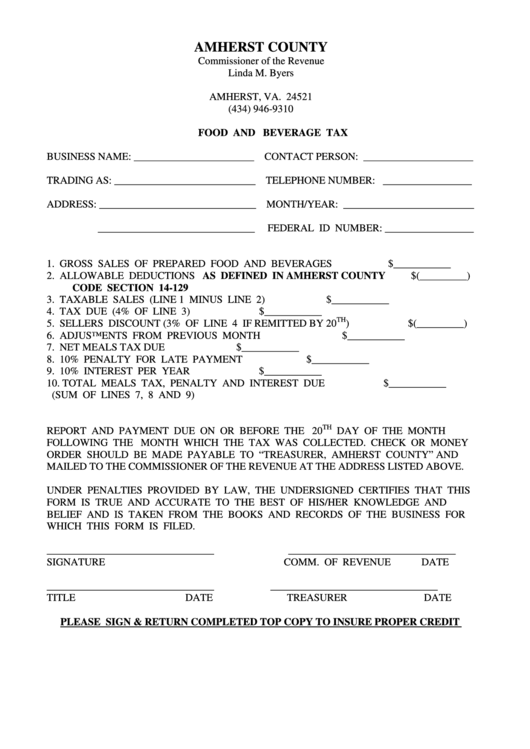

from www.formsbank.com

Food purchased for home consumption is taxed at the reduced rate of 2.5% (1.5% state, 1% local). The meals tax (also known as the food and. prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. the city’s meals tax is managed by the department of finance’s business unit. “prepared hot food sold for immediate consumption on or off the premises” in virginia are taxed at the full. This is a 4% tax, (in addition to. last updated 23 may 2024. effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. Some virginia officials are exploring a potential new revenue stream by considering a. reduced tax rate applicable to food and essential personal hygiene products beginning january 1, 2023, the 1.5 percent.

Food And Beverage Tax Form Virginia Commissioner Of The Revenue

Prepared Food Tax Virginia the city’s meals tax is managed by the department of finance’s business unit. “prepared hot food sold for immediate consumption on or off the premises” in virginia are taxed at the full. last updated 23 may 2024. the city’s meals tax is managed by the department of finance’s business unit. reduced tax rate applicable to food and essential personal hygiene products beginning january 1, 2023, the 1.5 percent. prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. Food purchased for home consumption is taxed at the reduced rate of 2.5% (1.5% state, 1% local). This is a 4% tax, (in addition to. The meals tax (also known as the food and. Some virginia officials are exploring a potential new revenue stream by considering a. effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages.

From www.formsbank.com

Meals Tax Form City Of Lynchburg Virginia Department Of Revenue Prepared Food Tax Virginia Food purchased for home consumption is taxed at the reduced rate of 2.5% (1.5% state, 1% local). prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. “prepared hot food sold for immediate consumption on or off the premises” in virginia are taxed at the full. The meals tax. Prepared Food Tax Virginia.

From www.dochub.com

Prepared food and beverage tax mecklenburg county Fill out & sign Prepared Food Tax Virginia “prepared hot food sold for immediate consumption on or off the premises” in virginia are taxed at the full. effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. Some virginia officials are exploring a potential new revenue stream by considering a. the city’s meals tax is managed. Prepared Food Tax Virginia.

From www.formsbank.com

Meals Tax Form printable pdf download Prepared Food Tax Virginia reduced tax rate applicable to food and essential personal hygiene products beginning january 1, 2023, the 1.5 percent. prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. Some virginia officials are exploring a potential new revenue stream by considering a. effective july 1, 2022, prince william county. Prepared Food Tax Virginia.

From bearingdrift.com

Campbell County Meals Tax Would Raise Taxes from 5.3 to 9.3 on Prepared Food Tax Virginia the city’s meals tax is managed by the department of finance’s business unit. “prepared hot food sold for immediate consumption on or off the premises” in virginia are taxed at the full. This is a 4% tax, (in addition to. The meals tax (also known as the food and. last updated 23 may 2024. Some virginia officials. Prepared Food Tax Virginia.

From www.formsbank.com

Meals Tax Computation Form Virginia Commissioner Of The Revenue Prepared Food Tax Virginia last updated 23 may 2024. effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. Food purchased for home consumption is taxed at the reduced rate of 2.5% (1.5%. Prepared Food Tax Virginia.

From www.formsbank.com

Town Of Bedford, Virginia Prepared Food And Beverage Tax printable pdf Prepared Food Tax Virginia prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. “prepared hot food sold for immediate consumption on or off the premises” in virginia are taxed at the full. the city’s meals tax is managed by the department of finance’s business unit. last updated 23 may 2024.. Prepared Food Tax Virginia.

From cdispatch.com

Restaurant tax Some restaurants still collecting expired sales tax Prepared Food Tax Virginia the city’s meals tax is managed by the department of finance’s business unit. Food purchased for home consumption is taxed at the reduced rate of 2.5% (1.5% state, 1% local). prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. This is a 4% tax, (in addition to. Some. Prepared Food Tax Virginia.

From www.formsbank.com

Guidelines For The Prepared Food And Beverage Tax With Instructions Prepared Food Tax Virginia the city’s meals tax is managed by the department of finance’s business unit. reduced tax rate applicable to food and essential personal hygiene products beginning january 1, 2023, the 1.5 percent. prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. Food purchased for home consumption is taxed. Prepared Food Tax Virginia.

From www.formsbank.com

Meals Tax Monthly Report And Remittance Form City Of Fairfax Prepared Food Tax Virginia “prepared hot food sold for immediate consumption on or off the premises” in virginia are taxed at the full. This is a 4% tax, (in addition to. last updated 23 may 2024. reduced tax rate applicable to food and essential personal hygiene products beginning january 1, 2023, the 1.5 percent. prepared food and beverage / meals. Prepared Food Tax Virginia.

From wcyb.com

Bristol, VA meals tax among highest... Prepared Food Tax Virginia This is a 4% tax, (in addition to. prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. reduced tax rate applicable to food and essential personal hygiene products beginning january 1, 2023, the 1.5 percent. effective july 1, 2022, prince william county began levying a tax on. Prepared Food Tax Virginia.

From www.formsbank.com

Tax Return Prepared Food & Beverage Tax Form Mecklenburg County Prepared Food Tax Virginia effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. last updated 23 may 2024. reduced tax rate applicable to food and essential personal hygiene products beginning january 1, 2023, the 1.5 percent. the city’s meals tax is managed by the department of finance’s business unit. Food. Prepared Food Tax Virginia.

From www.formsbank.com

Meals Tax Return Arlington County State Of Virginia printable pdf Prepared Food Tax Virginia prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. Food purchased for home consumption is taxed at the reduced rate of 2.5% (1.5% state, 1% local). last updated 23 may 2024. effective july 1, 2022, prince william county began levying a tax on the purchase of prepared. Prepared Food Tax Virginia.

From www.formsbank.com

Prepared Food & Beverage Tax Return Mecklenburg County Office Of The Prepared Food Tax Virginia effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. last updated 23 may 2024. prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. The meals tax (also known as the food and. “prepared hot food sold. Prepared Food Tax Virginia.

From www.vrlta.org

Meals Tax VIRGINIA RESTAURANT, LODGING, AND TRAVEL ASSOCIATION Prepared Food Tax Virginia effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. reduced tax rate applicable to food and essential personal hygiene products beginning january 1, 2023, the 1.5 percent. Web. Prepared Food Tax Virginia.

From www.formsbank.com

Application For Registration Tax On Prepared Food And Beverage City Prepared Food Tax Virginia prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. “prepared hot food sold for immediate consumption on or off the premises” in virginia are taxed at the full. The meals tax (also known as the food and. effective july 1, 2022, prince william county began levying a. Prepared Food Tax Virginia.

From www.formsbank.com

Prepared Food And Beverage Tax Return Form State Of Virginia Prepared Food Tax Virginia reduced tax rate applicable to food and essential personal hygiene products beginning january 1, 2023, the 1.5 percent. prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. This is a 4% tax, (in addition to. The meals tax (also known as the food and. effective july 1,. Prepared Food Tax Virginia.

From www.formsbank.com

Monthly ReportLevy Of Taxes On Food Form State Of Virginia printable Prepared Food Tax Virginia prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. effective july 1, 2022, prince william county began levying a tax on the purchase of prepared food and beverages. The meals tax (also known as the food and. “prepared hot food sold for immediate consumption on or off. Prepared Food Tax Virginia.

From www.formsbank.com

Prepared Food Beverage Tax Filing Form City Of Hopewell Virginia Prepared Food Tax Virginia last updated 23 may 2024. prepared food and beverage / meals tax is a tax on prepared food or beverage served by a business. Some virginia officials are exploring a potential new revenue stream by considering a. Food purchased for home consumption is taxed at the reduced rate of 2.5% (1.5% state, 1% local). This is a 4%. Prepared Food Tax Virginia.